As the end of the financial year comes to a close, a new minimum wage is due to take effect. Are you ready? Our factsheet will take you through what to expect, the relevant minimum wage categories and how you can prepare your business. The factsheet includes:

- The new minimum wage rates

- The differences between the different wage rates

- How employers can prepare for the change

Download our factsheet on the new minimum wage rates today.

What is the new minimum wage?

The new minimum wage rates in New Zealand come into effect on 1 April 2024. They vary depending on the type of minimum wage rate used for each employee. There are three categories of rates: the adult minimum wage, the starting-out wage and the training minimum wage.

Adult minimum wage

The adult minimum wage in New Zealand will increase from $22.70 to $23.15 gross per hour.

This minimum wage rate is applicable to employees aged 16 years and over who aren’t eligible for the starting-out or training wage. Employees who are involved in supervising or training other workers as part of their role, regardless of their age or training status, should also be on this wage.

Starting-out wage

For those on the starting-out wage, the minimum rate will increase from $18.16 per hour to $18.52 gross per hour.

The starting-out wage is applicable to the following employees:

- Those aged 16 or 17 years old, who have still to complete six months of continuous employment with their current employer

- Those aged 18 or 19 years old, who have been paid a specified social security benefit for six months or more, and who have not yet completed six months of continuous employment with their employer since being paid a benefit. These benefits could include jobseeker support, independent youth benefit, sole parent support or supported living payment. See the full list of benefits here.

Training minimum wage

Like the starting-out wage, the training minimum wage will increase from $18.16 per hour to $18.52 gross per hour.

The training minimum wage applies to employees aged 20 years or over, whose employment agreement states that they have to do at least 60 credits a year of an industry training programme or apprenticeship to become fully qualified.

It’s important to note that whatever minimum wage rate employees are on, they all have the same minimum rights and protections under New Zealand employment law.

How can employers prepare for this change?

It’s important to be prepared in advance. The wage increase may require multiple changes across your business and not having the change in place from 1 April onwards may lead to costly penalties.

Understand your obligations

First of all, this is a good time to make sure that as a business leader or payroll professional, you understand exactly what is required of employers in regards to the minimum wage. As well as the different minimum wage rates, you should understand that the minimum wage applies to all hours worked, and to employees on a salary, piece rates or commission.

The only exception to the minimum wage is for employees aged 15 years and younger, or in the case of an exemption permit for an employee with a disability that inhibits their ability to carry out their work. In the case of the exemption permit, this is a complex step, so ensure you’re getting legal advice before making any decisions. There are also parameters and restrictions that employers should be aware of when hiring employees aged 15 years and younger.

This period is also an opportunity to check that all your employees on the minimum wage rate are on the right type for them. For example, review those on the starting-out or training wages, and note when they will need to be moved to the adult minimum wage rate.

Let your team know

If you have any employees who are currently paid the minimum wage, you should inform them of the increase they will be receiving. This should be done in writing (letter or email) as an addendum to their employment contract. It is best practice to keep a copy of this change on the employee’s personnel file.

Check your payroll processes

Remember that the new minimum wage comes into effect at the end of the 2023-2024 financial year (EOFY). Make sure to factor the minimum wage change into any preparations for the 2024-2025 financial year.

Speak to those in charge of your payroll, whether that’s your payroll provider, finance team, HR department or accountant. Make sure they’re across the upcoming change and know how to adjust the settings. For those using payroll software, it may require a few manual tweaks to get everything ready to go.

Consider pay rates company-wide

Business leaders can also use this time to assess pay rates across their company. With those on the minimum wage receiving an increase, leaders may want to consider how that then compares with those on higher wages. They might look into a pay adjustment for other employees to maintain the relative difference.

Employers should note, unless the company has a policy or clause in the employment agreement, there is no obligation for all employees to receive pay rises if they are paid above the minimum wage.

Changing the minimum wage through Employment Hero

If you’re an Employment Hero Admin user, changing the rate for any employees on the minimum wage is quick and easy.

If you’re changing the rate for a single employee

You simply need to view the applicable employee’s pay rate template, and make the edit there.

The steps are:

- Click the Employee menu.

- Click the List submenu.

- Click on the employee who needs their pay rate template viewed.

- Click the Pay Rates button

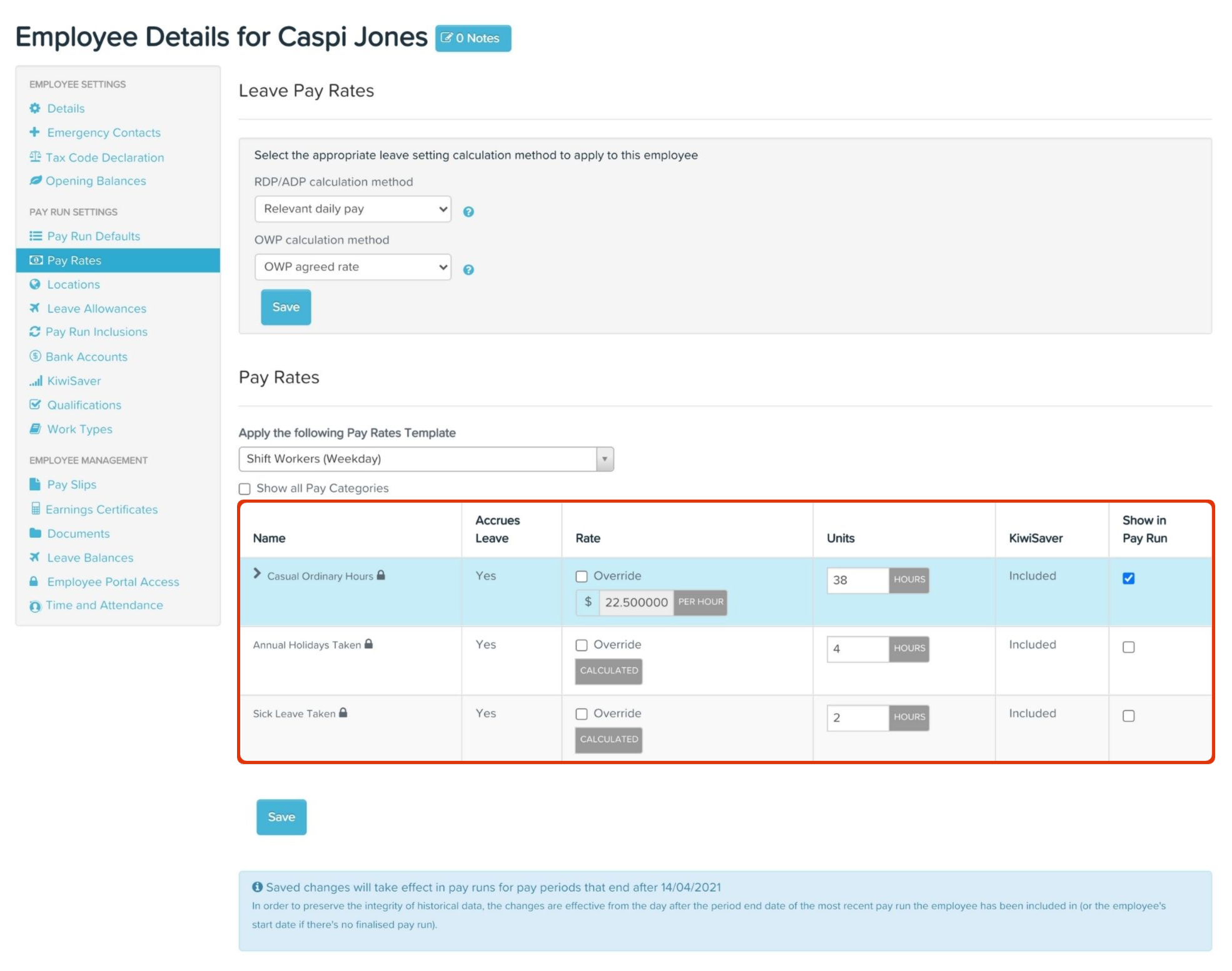

You will now see the employee pay rate on your screen. It should look something like this –

As you can see in the Rates column, you can now manually override the previous settings and update it to the current minimum wage rate. Just make that change, and you’re done!

If you’re changing the rate for multiple employees

First, you’ll need to identify and filter out which employees need to have their rate updated.

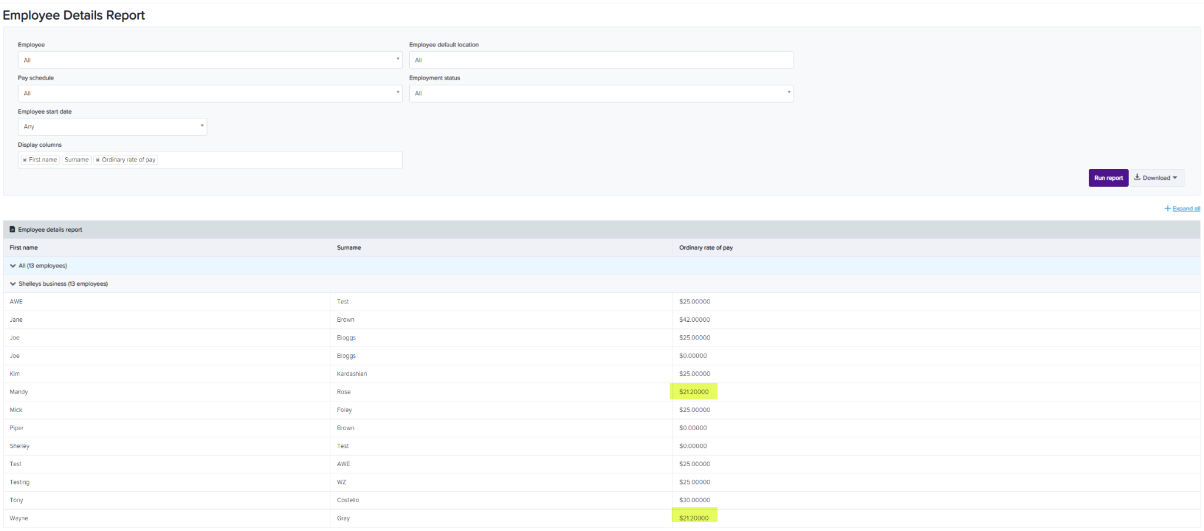

- Go to reports and choose the Employee Details Report.

- Select the field “Ordinary Rate of Pay” to be included in the report, then run it to screen or to a file and you can easily see which employees need to be updated.

In this screenshot, you can see that two employees need to have their rates updated to the new minimum.

Now to change the pay rate. Follow these steps:

- Go to Business Settings > Pay Conditions > Update Pay Rates.

- Click on Add Employees.

- Choose the employees you have identified as the ones to be updated.

- You will need to choose whether your pay rate update is a percentage or a dollar figure. For each employee selected you can enter the adjustment amount (in this case, the difference between the new rate and their current rate). This will then automatically calculate the future rate which will be their current rate plus the adjustment.

- You will be required to choose the date the new rate should commence.

- Click Save new pay rates.

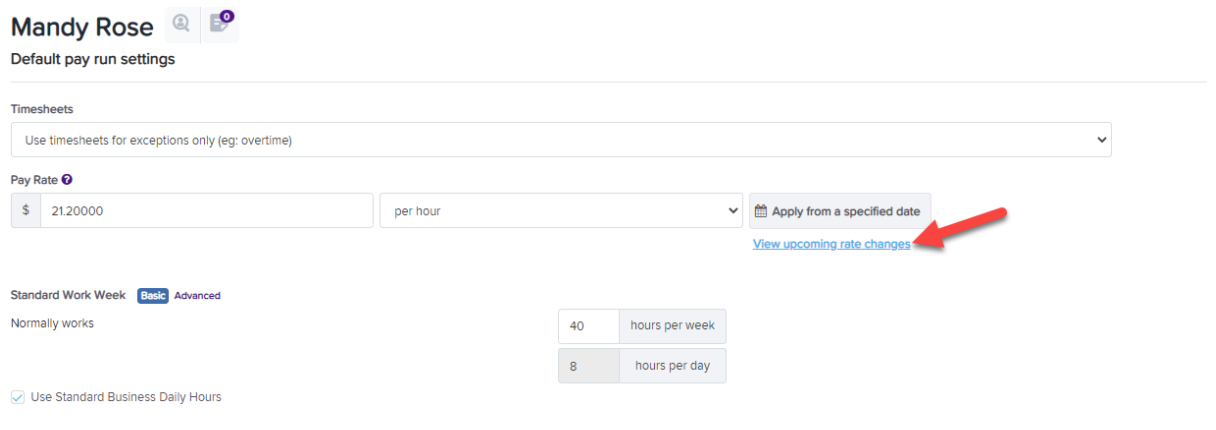

- In the Employee’s Pay Run Defaults screen, you will be able to see ‘View upcoming rate changes’.

- Clicking on this will open a context panel displaying the new rate and the date it is effective from.

Now, Employment Hero Payroll will automatically update those employees with the new minimum wage in line with the 1 April.

Employment Hero is your best partner for the end of financial year. Reach out to us today to find out how we can support you.

Disclaimer:The information in this article is current as at 23 March 2023, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The Information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article.You should undertake your own research and to seek professional advice before making any decisions or relying on the information in this article.

Check out our summaries of the latest NZ employment law updates here.